i haven t filed taxes in 10 years what do i do

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. To request past due return incomeinformation call the IRS at 866 681-4271.

Get Back On Track With The Irs When You Haven T Filed H R Block

CPA Professional Review.

. How many years of unfiled taxes do I have to file. In fact every year about 7 million taxpayers fail to file their income taxes returns. Order a Transcript.

If You Dont File Your Return the IRS May File a Return for You. Ad Over 1500 5 Star Reviews. Rated 1 Overall by Investopedia.

Yet there are more than 146 million Americans who do file their returns year on year. Maximize Your Tax Refund. 0 Federal 1799 State.

Ad We Can Help With Wage Garnishments Liens Levies and more. The deadline to apply for the waiver is 1159 pm. The following are some of the prior year forms and schedules you may need to file your past due returns.

After April 15 2022 you will lose the 2016. Ad Prevent Tax Liens From Being Imposed On You. See if youre getting refunds.

Get Help With 10 Years of Unfiled Taxes. A Rated W BBB. A recorded message will guide you.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. This is called a substitute for return SFR. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

Theres that failure to file and failure to pay penalty. The Department of Education has a dedicated tool to help guide your application for the limited waiver. Order a transcript by phone at 800-908-9946.

Get Immediate Help with a Free Confidential Consultation. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. See if youre getting refunds.

You will also be required to pay penalties for non-compliance. Penalties include up to one year in prison for each year you. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign.

Havent Filed Taxes in 10 Years. Contact the CRA. A Rated W BBB.

Start with a free consultation. Get Help With 10 Years of Unfiled Taxes. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure.

If you havent filed tax returns the IRS may file for you. Overview of Basic IRS filing requirements. You will owe more than the taxes you didnt pay on time.

If you dont file a tax return you will be in violation of the law. Get Immediate Help with a Free Confidential Consultation. If you owe tax the IRS will impose a failure-to-file penalty for 5 of the tax owed per month that you are late.

To place your order online go to the Get Transcript tool on the IRS website. 2 days ago If two different instructions for changing the ownership of the same. Easily make changes to your 2021 tax return online up to 3 years after its been filed and accepted by the IRS.

The IRS requires you to go back and file your last six years of tax returns to get in their good graces. How much money you could be getting from child tax credit and stimulus payments. Before April 15 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

Ad Over 1500 5 Star Reviews. Quickly Prepare and File Your Unfiled Taxes. If your return wasnt filed by the due date including extensions of time to file.

This penalty applies the first day you are late and it can get up to 25 of the. You owe fees on the. Usually the IRS requires you to file.

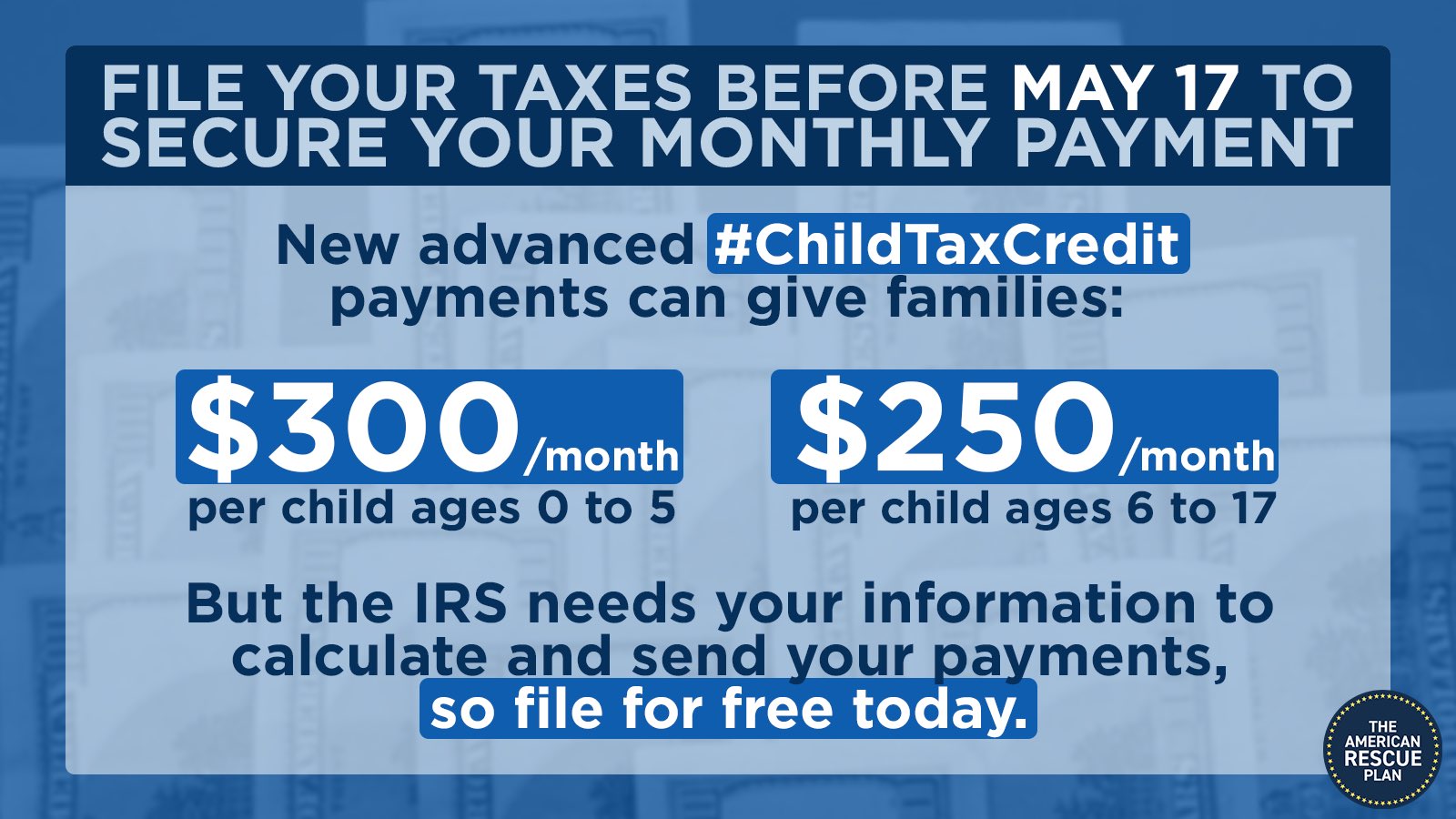

Rated 1 Overall by Investopedia. You are only required to file a tax return if you meet specific requirements in a given tax year. Up to 3600 per child or up to 1800 per child if you received.

What happens if you havent filed taxes for several years. After May 17th you will lose the 2018. Ad Quickly Prepare and File Your Prior Year Tax Return.

Need help with Back Taxes. Enhanced child tax credit. That said youll want to contact them as soon as.

I Haven T Filed Income Taxes Will My Personal Injury Claim Be Affected

Yarn Your Grandmother Hasn T Paid Taxes In 10 Years Happy Gilmore 1996 Video Clips By Quotes F0da920e 紗

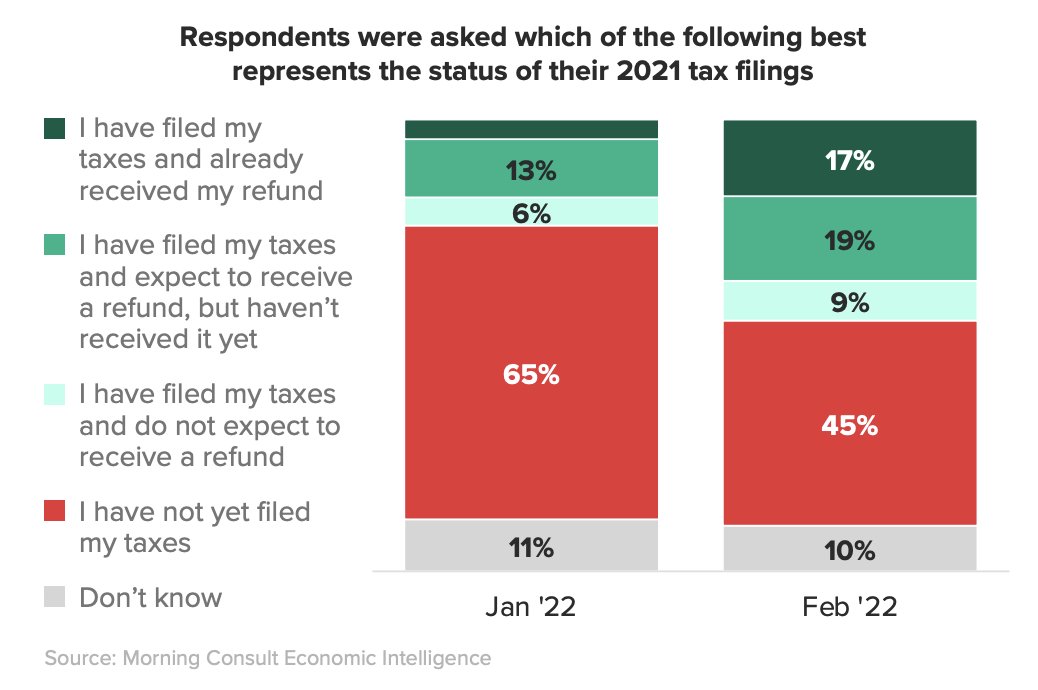

تويتر Morning Consult على تويتر More Than A Third Of Adults Who Have Filed Their Tax Returns And Expect To Receive A Refund Haven T Gotten It Yet Implying That Many Will

What To Know About The Third Stimulus Checks Get It Back

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What Happens If I Haven T Filed Taxes In Over Ten Years

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Gm Ford Rarely Pay Federal Taxes Yet Get Fat Refunds Here S Why

Haven T Filed Your Taxes Yet Act Soon To Avoid Penalties Financial Avenue

:max_bytes(150000):strip_icc()/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

Tax Refund Missing Reasons You Never Received One

Anthony Bourdain Owed 10 Years Of Taxes

Haven T Filed Your Taxes Yet You Still Have Time To Get An Extension From The Irs Fort Worth Star Telegram

Donald Trump Tries New Line Of Defence Amid Tax Scandal South China Morning Post

What To Do If You Haven T Paid Your Taxes During The Pandemic

How To Complete The Fafsa When Parent Didn T File Tax Return Fastweb

Have You Filed Your Taxes Yet If Not Here Are Tips For Procrastinators Orange County Register

Rep Darren Soto On Twitter Thanks To The Americanrescueplan 185 100 Children In Fl09 Could Benefit From The Expanded Childtaxcredit If You Haven T Filed Your 2020 Taxes Make Sure To Do So Before